do you pay sales tax on a leased car in california

Of this 125 percent goes to. At the end of the lease you would pay salesuse tax on any buyout option that you elect to exercise if there is one.

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

In addition the vessel must be leased in substantially the same form as acquired.

. In CA you are allowed to payoff your leased car in order to resell it without paying taxes on the payoff IF you can sell it back and to a third party which would need to register the car within ten days of the original leasee recieving the title form the lessor company. You made a timely election to report and pay use tax measured by the purchase price. This page covers the most important aspects of Californias sales tax with respects to vehicle purchases.

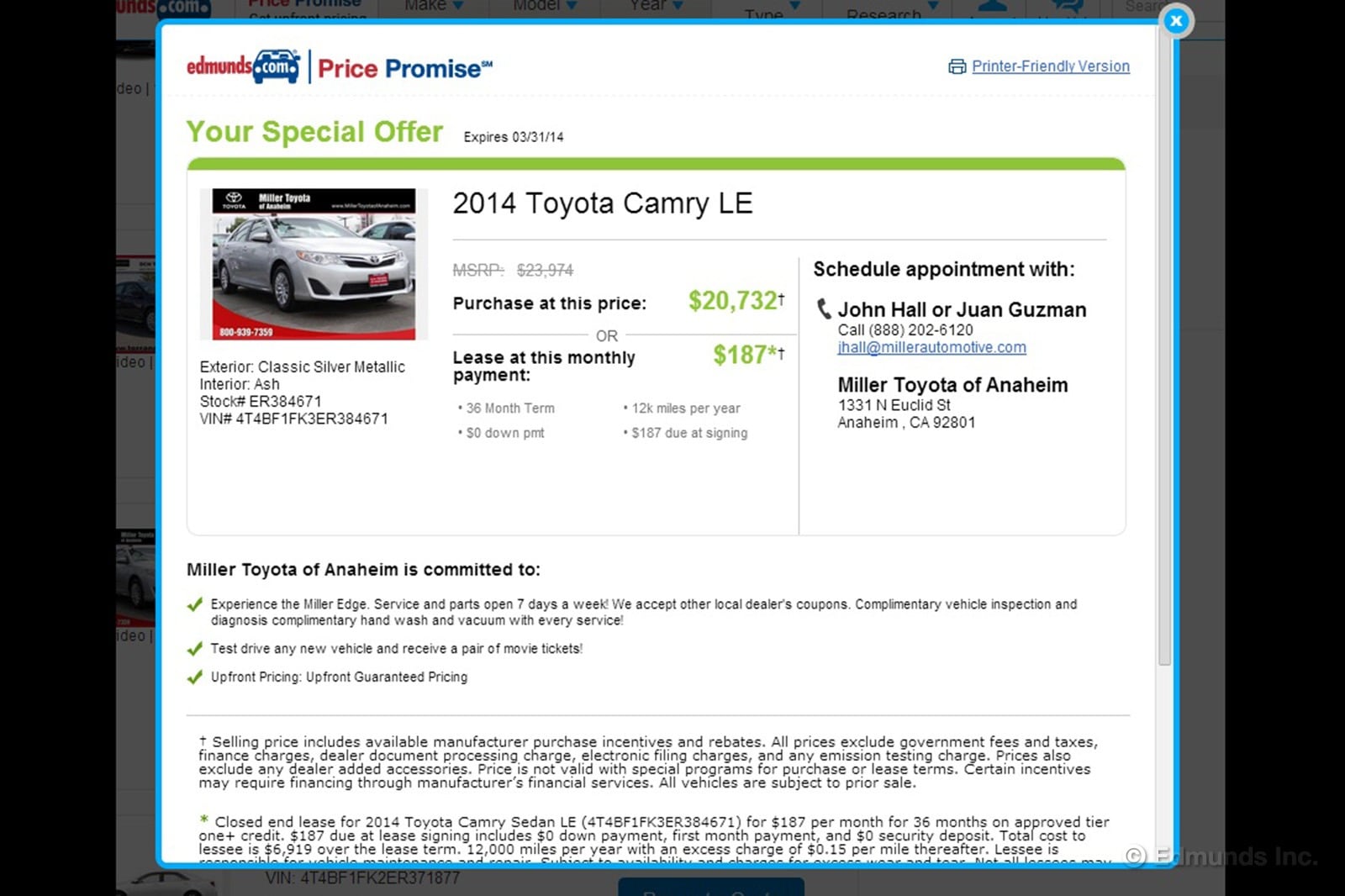

California Sales Tax on Car Purchases According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent. This means that you pay sales tax on the monthly payment not on the selling price of the car. Depending on where you live leasing a car can trigger different tax consequences.

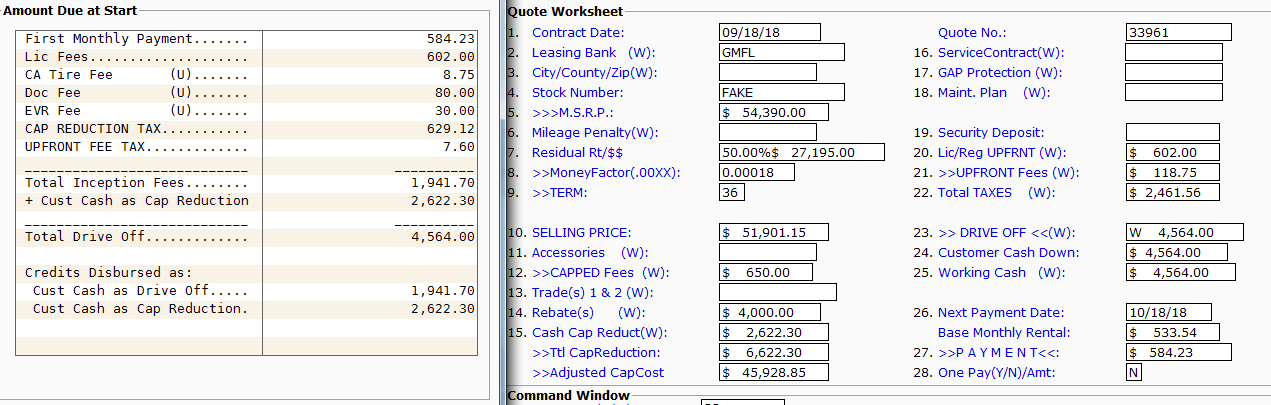

You may also have to pay an acquisition fee to the bank and a down payment called a cap reduction fee During the lease you pay your monthly payment insurance premiums ongoing maintenance costs and annual vehicle registration fees. However when the lessee is not subject to use tax then sales tax on the lessor applies except with leases to the United States Government which are exempt. The minimum is 725.

You can deduct sales tax on a new or used purchased or leased vehicle or boat but if you live in a state with a state income tax it probably isn t to your advantage to do so. Sells the vehicle within 10 days use tax is due only from the third party. Well if you currently live in California then yes.

Local governments such as districts and cities can collect. Dear Driving for Dollars My lease is almost up and I would like to purchase the car. Like with any purchase the rules on when and how much sales tax youll pay.

This means that salesuse tax applies to your down-payment if any and to each monthly lease payment. Love the car so far. The most common method is to tax monthly lease payments at the local sales tax rate.

For example the california car sales tax is 725. Sells the vehicle after 10 days use. This page describes the taxability of leases and rentals in California including motor vehicles and tangible media property.

Act 1164 of 2013 repealed th second option leaving only the e first option that lessors must collect tax on the long term rental. In addition to a sales tax youll probably also have to pay some registration fees when leasing a car. I chose to lease a MY.

For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725. For vehicles that are being rented or leased see see taxation of leases and rentals. The 10 day window is the easiest way to execute the transaction with the DMV.

With a lease you dont pay the sales tax up front. 1450 is how much you would need to pay in sales tax for the vehicle regardless of if it was used purchased with. These can vary from state to state falling in the range of 50 to 750.

For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure. Sales tax is a part of buying and leasing cars in states that charge it. I emailed Tesla Financial about it and the response I received was that the sales tax is 925 to explain the total amount.

This means you only pay tax on the part of the car you lease not the entire value of the car. Do you pay sales tax on a leased car in california. No sales or use tax is due with respect to the rentals charged for tangible personal property leased in substantially the same form as acquired by the lessor or by his or her transferor as to which the lessor or transferor has paid sales tax reimbursement or has paid use tax measured by the purchase price.

Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. You just have to pay for licensing titling and registration. When you lease a vehicle you will pay a use tax in most states.

For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure. Use tax is due. In some places youll have to pay sales or excise tax on the amount you put down plus your monthly payments.

Despite many deals advertising zero-down leases leasing a car can be more expensive than you might realize. But typically salesuse tax for a leased vehicle in California is pay-as-you-go. So when you switch to a conventional purchase.

You pay sales tax monthly based on the amount of your payment. Download this image for free in High-Definition resolution the choice download button below. I just received my first monthly lease bill and it was a little higher than originally stated.

Remember automobile sales tax is collected by the DMV on behalf the tax authorities in California. In some states such as Oregon and New Hampshire theres no sales tax at all. While Californias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Bottom Line on Fees. I know the pros cons of buying versus leasing which I dont want to discuss here. 20000 X 0725 1450.

If the transaction takes longer than ten days the seller documents the odometer reading at the beginning of the process the odometer at the actual sale with an. To learn more see a full list of taxable and tax-exempt items in California. Generally transactions that qualify as exempt sales will also qualify as exempt leases.

California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments. Do you pay sales tax when leasing a car is important information accompanied by photo and HD pictures sourced from all websites in the world. You paid sales tax at the time you purchased the vessel or.

Multiply the vehicle price before trade-in or incentives by the sales tax fee. The dealership is telling me that I will need to pay sales.

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Ending Your Car Lease Is Tricky But Can Still Pay Off Cleveland Com

How To Lease A Car Credit Karma

Why Car Leasing Is Popular In California

Why You Should Buy Your Leased Car Forbes Wheels

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Featured Lease Specials At Audi Dallas In Dallas Tx

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Leasing Vs Buying A Car Which Option Is Right For You

Consider Selling Your Car Before Your Lease Ends Edmunds

What Happens If You Crash A Leased Car Gordon Gordon Law Firm

How Does Leasing A Car Work Earnest

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

California Lease Tax Question Ask The Hackrs Forum Leasehackr

You Can Sell Your Leased Car For A Profit Here S How Much Yaa

Should I Buy Or Lease My New Business Vehicle 2022 Turbotax Canada Tips